When your plan gaps, other insurance coverage providers might end that you either can't make your settlements on schedule or are undependable. Regardless, it can avoid you from obtaining a great policy at a cost effective rate. Some firms will not accept you for a plan at any rate because they see you as a risk.

Prior to you start gathering home insurance policy quotes, collect: Personal details like your motorist's permit as well as social security number, Your address (if you recently relocated or are relocating and don't know it off the top of your head)Info on any kind of recent fixings or restorations to the residence, including the cost of those repair work or restorations, Information concerning your home's present problem (Is the roofing system old? A residence stock, Producing your house supply, Your house stock need to note everything you have in your house or plan to store there. insurer.

Whenever possible, affix receipts or appraisals to your house supply to reveal what the products are worth. If the product has a version number or identification number, include those also. It seems exhausting to make this home stock, yet if you do and also you provide it to your residence insurance policy provider, you assure that whatever on the list has protection (low cost homeowners insurance).

The company will normally call you to arrange a see so you can be house to allow the inspector in, yet assessments can also happen without warning. Examinations generally take a few minutes to a few hrs relying on how large your residential property is. Find out exactly how to review your plan, To ensure you have the best amount of coverage, assess your residence supply with your agent. property insurance.

Regrettably, the majority of people just figure out they do not have enough insurance coverage after disaster strikes. Come to be familiar with what each section of your plan covers to make sure that you can describe it if you need to make a claim. What should my property owners insurance plan cover? According to the National Association of Insurance Coverage Commissioners (NAIC), most home policies have at least 6 sections that define sorts of insurance coverage.

Not known Facts About How Much Does Homeowners Insurance Cost? - Allstate

This area covers other structures on your building (cheaper homeowners insurance). This can consist of sheds, removed garages and secure fencing. Area C covers the things that you maintain in your residence. This can consist of everything from high-end stereo equipment to your youngsters's clothes. Like Area A, you have some adaptability here, so select a protection amount that makes you feel comfortable.

Let's say that a fire loads your residence with smoke and also triggers comprehensive damages. Your family needs to move into a resort during residence repair services. This area defines just how much money you can obtain for those extra expenditures, including your resort expense and also restaurant tabs due to the fact that you won't have accessibility to your kitchen area.

It can help you cover the cost of a legal situation if your neighbor journeys as well as drops on your icy steps, for instance, or if your child tosses a round with the next-door neighbor's home window - cheapest insurance. If somebody gets wounded on your building, Area F of your insurance coverage policy protects you from medical costs.

Without added plans that cover these voids in protection, you do not have any type of defense against some usual calamities. All informed, make sure you're putting various other policies in place any place your house insurance coverage leaves gaps.

insurance cheap landlord for home homeowner insurance home insurance

insurance cheap landlord for home homeowner insurance home insurance

You can keep those costs to a minimum by comparing house insurance policy quotes - homeowners insurance. Your home insurance policy cost is one-of-a-kind to you relying on where you live, your residence as well as what you own. The only means to know you're obtaining the most effective residence insurance policy cost is to gather numerous house insurance prices quote from different service providers.

The 2-Minute Rule for Veterans' Mortgage Life Insurance (Vmli)

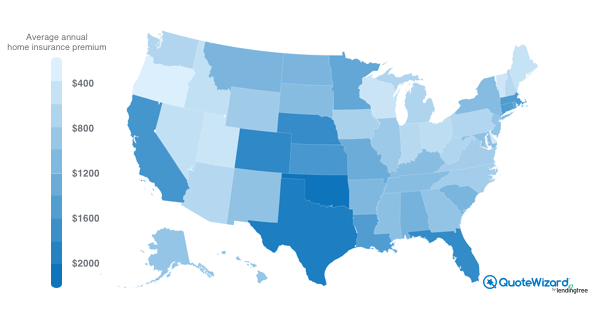

Integrating plans you need like residence and vehicle can help you rack up considerable cost savings. Just how much does property owners insurance cost? The price of your plan is mosting likely to rely on you. That claimed, recognizing some standards can help you shop educated. The typical property owner in the United States pays just over $1,220 for their plan yearly.

If you might conveniently move to your other home, you could not need this defense. People who have older residences, Don't presume that due to the fact that your home is aging you don't need much insurance coverage (landlord). You want to have enough home owners insurance policy to be able to rebuild approximately your existing quality of life standards.

Young, single purchasers, A young individual that doesn't have any children might not need as much insurance coverage as a family - a home owners insurance. When you do not need to worry about shielding youngsters and other household participants, then you can typically increase your deductible, save more money and approve higher threat. Young families, If you begin a family, your insurance policy requires might alter.

Find a quality provider, Now that you recognize what degree of coverage you need, you can start contrasting companies and also policies - finances. The NAIC will tell you whether an insurance policy business has actually gotten problems concerning things like: Insurance claim handling delays, Case rejections, Unsuitable negotiation deals, Canceling plans, Poor client service, You can also contact your state's Insurance Compensation to find out more about the insurance business that offer your area and also to discover a listing of all licensed insurance agents and also brokers.

You may have a couple of outliers (companies that charge extremely high or reduced costs), but many of them will cluster in a cost variety. Be careful of firms that offer extremely affordable price. They're appealing to purchasers, however they usually have low cost for a reason. Keep in mind that consumer solution issues also.

7 Easy Facts About How Much Does Home Insurance Cost? Average Costs In 2022 Described

property insurance for home insurance property insurance homeowner insurance credit

property insurance for home insurance property insurance homeowner insurance credit

Each one can have an effect on just how much you pay yearly. Raise your insurance deductible, Your deductible is the quantity of money you have to spend out-of-pocket prior to the insurance policy company begins footing the bill. Raising the deductible makes you a lot more responsible and also lowers the insurance company's threat. insurance claims.

Various other memberships show insurer that you are the type of customer they desire. Ask business to give you details concerning price cuts so you can check out every one of your alternatives. You do not intend to miss out on any type of method to reduce your insurance policy prices. Even if you just save a tiny amount every year, those discount rates include up to big financial savings.

Switching over erratically from business to company can make Article source you look risky. Insurer frequently share details with each other, so they know that you jump from policy to plan (cheapest homeowners insurance). Never quit purchasing, Sticking with the very same house insurance firm for many years can lead to cheaper rates. Still, this does not imply you need to always remain with the exact same company permanently.

By comparing insurance provider every few years, you can see to it that you never ever pay more for the protection that you require. Simply do not make a habit of switching carriers annually - insurance premium. The takeaway, You do not have to be an insurance professional to get a bargain on a residence policy.

Fraud does exist in the insurance world. You do not wish to succumb underhanded companies, Some licensed insurance provider offer better solutions than others. insurance claims. Utilize the NAIC data source to make certain you select a business with few issues, And also to assist you as you go shopping, right here's a fast glossary of terms: The added expenses you incur when you can't live in your house as a result of a protected reason and also where your plan protects you The specific points your policy protects you versus The quantity you pay out-of-pocket before your protection begins Your monetary duty if someone gets harmed on your home or your reason property damage, The quantity of protection your policy consists of, after which you are in charge of all costs, The amount you pay for your insurance coverage, As long as you maintain these standard factors in mind, you need to have the ability to browse the insurance coverage globe without as well lots of problems.

How Much Does Home Insurance Cost? Average Costs In 2022 - An Overview

Getting house insurance coverage can feel demanding, but you have much more control over the situation than you realize. Educated, savvy customers can make better choices than those who do not recognize just how to compare alternatives or also obtain the information that they require to contrast plans. With this home insurance policy overview, you're prepared to decide that will certainly secure your residence and household without investing even more cash than required.

Area Safety, When you're thinking about growing origins in a new community or city, it's essential to understand simply exactly how safe your brand-new neighborhood is. While there are lots of details you will want to ask your realtor regarding the community in order to ensure the protection of your residence as well as family members, two of the most important things to discover are how far your house is from a fire hydrant as well as what the distance is to the closest neighborhood fire division - lowest homeowners insurance.

Homes that are situated in close proximity to fire hydrants and a permanently staffed fire department can expect to pay much less in insurance coverage. cheapest insurance., or in a community that has experienced a current spike in thefts and also criminal damage, you will likely see this mirrored in higher residence insurance policy prices.

That's since some carriers consider specific types to be much more hostile, and as a result more of a risk to insure. To avoid a considerable rise to your house insurance coverage, though, your Morse insurance coverage agent will ask you concerning the background and also character of your four-legged companion and attempt to put your plan with a provider that is much more dog-friendly (for home owners insurance).

Nonetheless, it is essential to recognize that your insurance service provider will likely consider any type of past cases when establishing your insurance policy costs. Insurers think that a history of claims, despite dimension and also extent, generally corresponds to a higher risk insured. On the other side, if you have actually revealed that you're a liable home owner, with minimal to no cases on your record, you might be qualified for a reduced property owners price as well as a range of cost-saving discount rates - deductible.

The Greatest Guide To Average Homeowners Insurance Rates By State 2022

One means that we are able to reduce your costs is by discovering cost-saving discounts with our choose group of top nationwide insurance service providers (homeowners policy). Below are three of the most common discounts offered to homeowners, but we also have access to numerous other means you could be able to save money on your home insurance.

If you pack your house and also auto insurance plan with the same insurance provider, a lot of the top providers will certainly award you with approximately 20 percent off your premium. It's tempting to look around when your insurance coverage rates increase. By doing so, you may be missing out on out on the benefits that some insurers supply to their most dedicated customers.

for home homeowners cheaper homeowners insurance homeowners insurance affordable

for home homeowners cheaper homeowners insurance homeowners insurance affordable

Setting up smoke alarm, an alarm system and dead-bolt locks will certainly not only enhance the total security of your residence however may additionally lower your insurance expenses. While the level of financial savings varies amongst insurance policy carriers, you can expect to receive anywhere from 5 to 20 percent off your costs for taking these simple safety and security procedures in your house.

At Morse, we will certainly not only take the needed steps to construct you a proper home insurance coverage that fits your spending plan, however we will certainly additionally see to it that you understand specifically what you are paying for. Whether you are in the market to purchase a new residence or you are a current homeowner that would like even more insight into why you are paying what you are for residence insurance coverage, the dedicated team at Morse would certainly enjoy nothing even more than the possibility to meet with you, learn even more about your certain house insurance needs, and customize a property owners insurance coverage plan that is just right for you.