Every U.S. state with the exemption of New Hampshire needs its drivers to acquire liability insurance policy to drive legitimately. Nonetheless, crash and extensive are optional, despite the fact that nearly four out of five vehicle drivers pick to buy these protections. Collision insurance coverage Collision spends for damages to your cars and truck resulting from a collision with an object (e.

The average price has to do with $290 each year. Accident coverage compensates you for the costs of fixing your car, minus the deductible. Crash protection additionally covers damages brought on by potholes. Comprehensive protection Comprehensive covers damages to your automobile triggered by catastrophes "various other than collisions," as well as sets you back substantially much less than crash protection.

Little Known Questions About 5 Types Of Car Insurance Coverage Explained - 21st.com.

What Is Comprehensive Insurance policy? It can help pay for damages caused by hailstorm, theft, fire or striking a pet.

When you pay that, your automobile insurance coverage will cover the remainder of your expenses, up to your limitation. Allow's state your car is damaged and will certainly cost $6,000 to fix, and your deductible is $1,000. You'll only pay out of pocket for the $1,000 insurance deductible, as well as then your insurance provider will certainly pay the various other $5,000 on your extensive insurance claim.

The smart Trick of Comprehensive Vs. Collision Insurance: What's The Difference ... That Nobody is Talking About

Just how much is your car worth? If it's much less than what you 'd pay for your insurance coverage costs, this protection might not deserve it. Do you live in a heavily booming location? Cities and towns with greater populations can also have even more crime that you might desire protection from. What Is the Difference In Between Comprehensive as well as Accident Insurance Policy? It's simple to blend comprehensive and also collision insurance.

It aids pay for problems that are outside of your control. If an all-natural disaster or pet problems your vehicle, this insurance coverage can help pay to fix it.

Automobile Insurance - Department Of Insurance, Sc - Official ... Things To Know Before You Get This

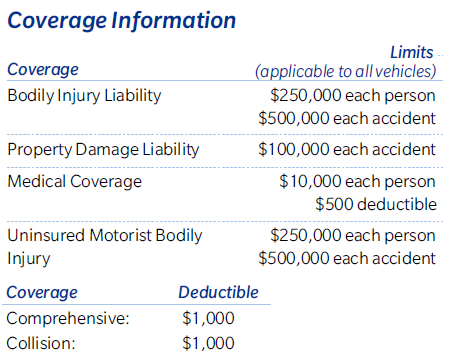

Some insurers supply policies with a combined solitary overall restriction for both bodily injury obligation and residential or commercial property damage obligation, instead than separate restrictions, which would then pay up to a solitary maximum quantity for all damages triggered by one crash despite the number of persons are injured (e. g., $100,000, $300,000 or $500,000).

You additionally have the alternative to increase this basic defense. For an additional costs, you can purchase greater protection limitations of Supplementary Uninsured/Underinsured Motorists (SUM) coverage of up to $250,000 per individual per mishap and $500,000 per accident, subject to the per individual limitation ($ 250,000/$ 500,000). Many insurers provide greater restrictions of AMOUNT insurance coverage.

Facts About Auto Insurance - Comprehensive Coverage - Horace Mann Uncovered

Nonetheless, the quantity of AMOUNT coverage might not surpass the physical injury responsibility restrictions of your plan. If SUM coverage has been acquired as well as you have a crash with one more car that is guaranteed yet has bodily injury liability limitations less than yours, or if such vehicle has no insurance in any way, AMOUNT protection will be activated.

Therefore, if you are ever before associated with an accident with other motorists, you can be sure that all member of the family who reside in your family are secured a minimum of as much as the quantity of SUM protection you have bought from your very own insurance provider. Accident Protection With this optional insurance coverage, your own insurer pays you, regardless mistake, for damages to your car triggered by an accident with an additional car or any type of various other things or your cars and truck reversing.

The 10-Second Trick For Auto Comprehensive Insurance Coverage - Travelers Insurance

This insurance covers the obligation of an insured since of the fatality of or injury to his or her spouse for the liability insurance restricts offered under the plan. You should request this added coverage from your insurance company as well as pay an additional premium for it unless your firm is offering this coverage at no fee.

When you're looking for auto insurance coverage something that's a lawful requirement in the majority of areas when you own an auto among the largest inquiries that comes your way is whether or not you should have liability protection or comprehensive coverage on your vehicle. Liability protection is typically more affordable, however comprehensive coverage covers more.

An Unbiased View of Cost Vs. Benefit Analysis: Comprehensive Car Insurance

Liability coverage does not cover any type of damages to your very own lorry in the instance of a mishap. What it does cover is any damages done to other cars that you're lawfully obliged to cover. For instance, if you remain in a traffic crash where you are at fault and you damage one more cars and truck, responsibility insurance policy kicks in.